Outlook for expiring IT sourcing contracts 2017-2018

Inspiration by expiration

With the end of the year approaching, sales plans are once again modified or created. It is the perfect moment to take a closer look at the expiring Dutch IT contracts.

Expiring contracts are an important source of information to be able to assess opportunities well before they come into play on the market. Depending on the specific service portfolio and the chosen sector approach, this information could be of great value to sales, marketing and business development professionals in the IT industry. This information could also be used by consultants, lawyers and specialists to identify interesting prospects.

Why customer change supplier

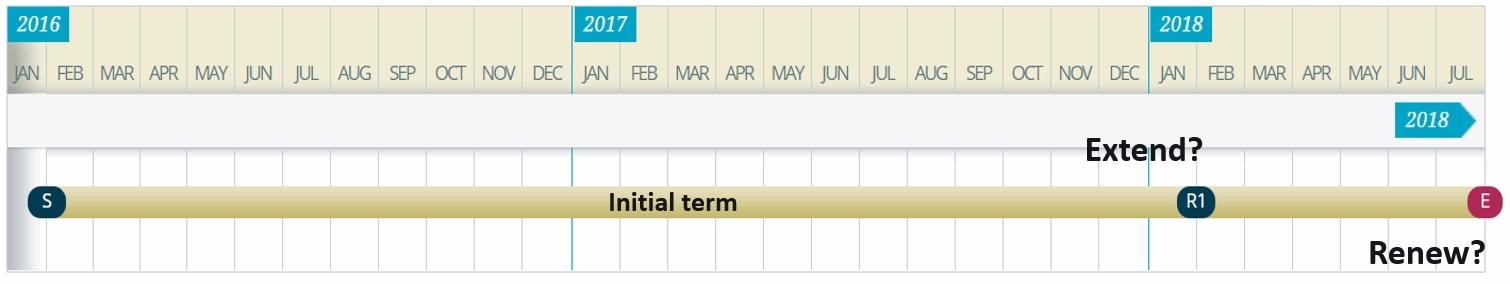

Customers will have to decide, in all cases, whether it is desirable to extend their contract with the same supplier well before the end of the initial term as well as the end of the overall duration of the contract.

Although the costs and risks that come with changing supplier could form an obstacle, customers do consider this option because, in reality, the contract provides this option.

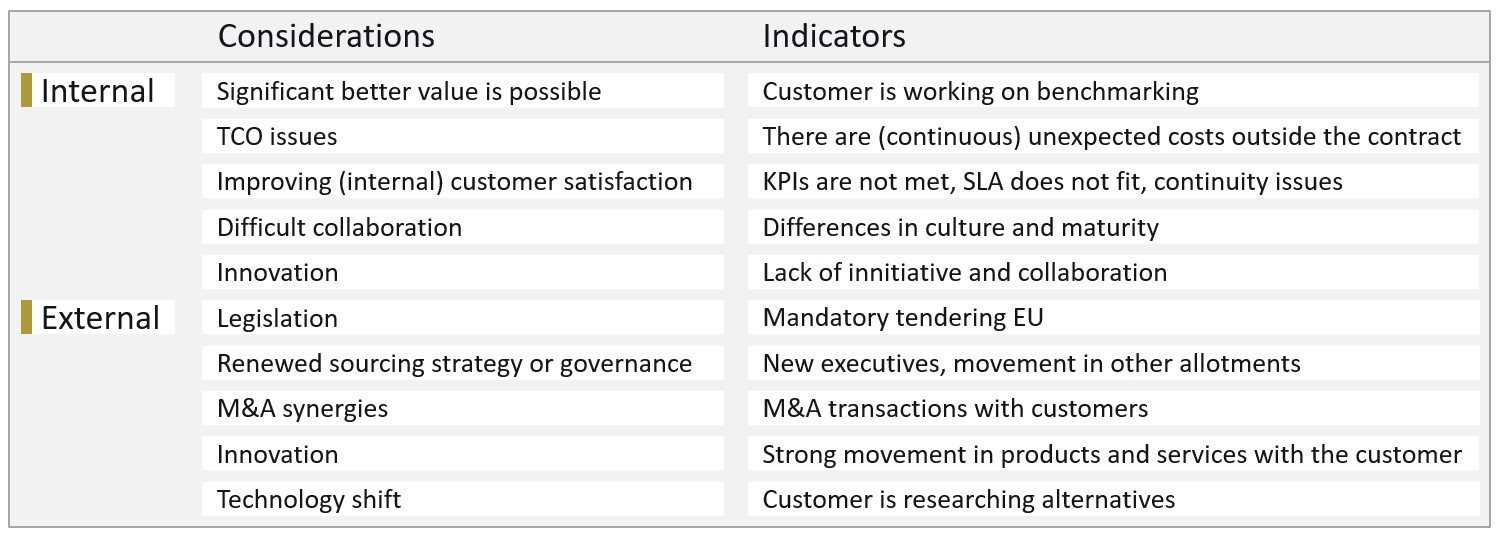

There may be several reasons to reconsider (part of) the contract. It may be that the customer could be dissatisfied about the current state of affairs, but there may also be reasons that go beyond the existing cooperation.

In addition to the service portfolio and the sector approach, these customer considerations are vital to suppliers to be able to qualify potential opportunities and subsequently be able to prioritise them.

The qualifying of expiring opportunities requires a little more effort, but the supplier who invests some time in this will ultimately have a head start on the competition who wait for a RFI/RFP to possibly fall into their lap.

Nearly 1000 contracts will be ended or renewed in the coming two years

Our analysis shows that 993 contracts will be expiring or renewed during the next two years; these transactions will indeed have to be tendered (public sector) or reconsidered (private sector). The graph below depicts an estimate of the timing of the three types of opportunities that were analysed.

-

There are 414 contracts that offer the customer the possibility to change supplier.

(end initial term)

-

There is a total of 417 contracts that will expire in 2017 or 2018.

(end total term)

- There are 162 contracts of which only the start date is known and of which we assumed an initial term of 24 months.

521 of the 993 contracts are contracts that are part of a transaction in which multiple suppliers are involved, such as framework agreements, partnerships and consortia. All contracts in this analysis have an estimated minimal total contract value of 1 million euro.

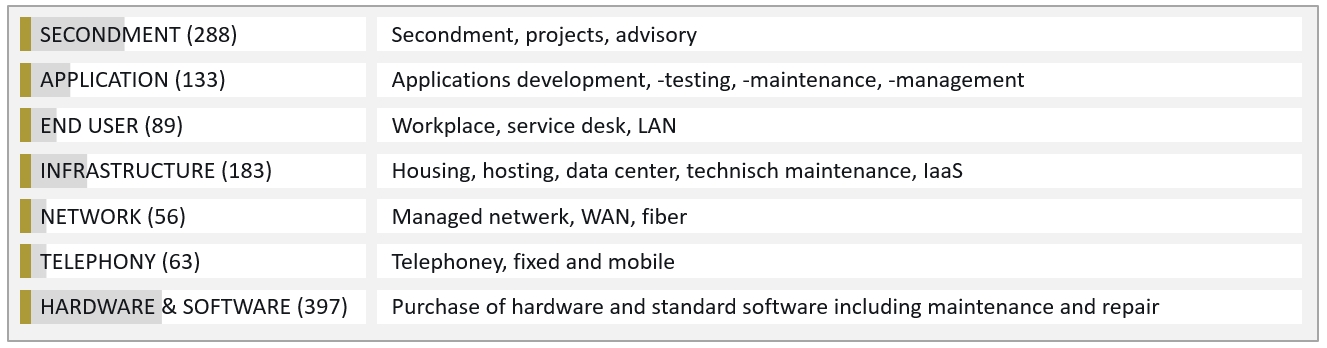

Profile on services portfolio

Below analysis shows the number of contracts based on contracted services. A necessary side note to this should be that a contract could include multiple services.

Specialist services such as the delivery of radius connections, industrial automation, GEO, audio and video have been disregarded in this analysis.

Risk and growth potential

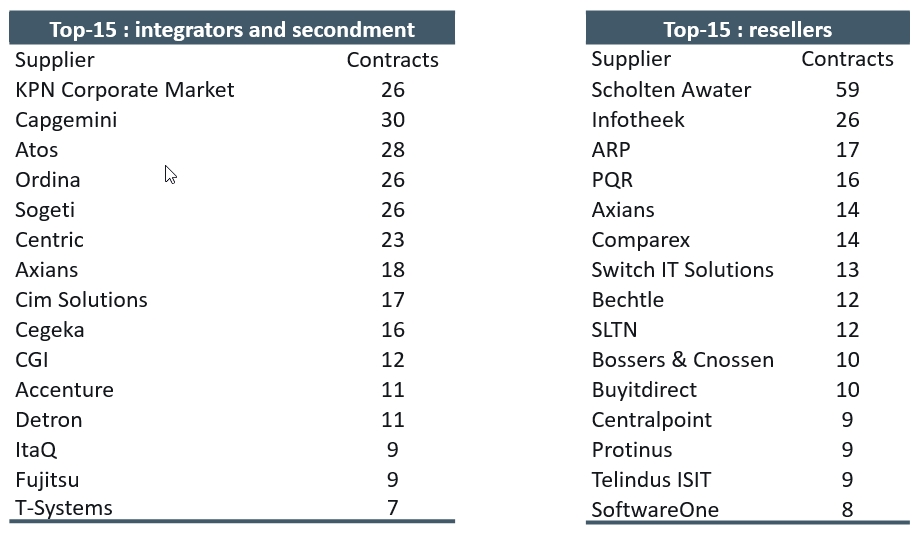

The more successful a supplier has been in the previous years, the more commercial risks emerge on the one hand (losing existing contracts) and the more growth potential there is on the other hand (up- and cross-selling). The end of the initial term or a total duration of a contract is a benchmark for customers to evaluate the performance of and the relationship with the supplier. The fruits of a healthy collaboration could of course also be a reason to deepen or broaden the relationship when the supplier takes the right initiatives.

The following tables indicate the number of contracts per supplier in which the initial term or the end date is approaching within the next two years. Together, these suppliers are responsible for about 50% of the expiring contracts that are known to us.

Inspiration by expiration?

What seemed like a good deal years ago might not be such a good deal anymore today. Suppliers should continuously look for possible improvements. Customers expect more than just good value; they want improved flexibility (upscaling/downscaling), the collaboration should remain appropriate within the changing sourcing strategy and governance of the customer. In addition, customers expect added value when it comes to innovation within and outside the scope of the contract. This could all lead to a source of inspiration for the suppliers to better serve existing and new customers.

The information used for this preview of the contract extensions and expirations comes from VPPipeline. Subscribers have direct access to the online expiration calendar, all available contract details and related publications. On request we provide customized contract expiration Excel extracts.

Need Help?

Evaluate VPPipeline

Monitor what's happening in the Dutch ICT market. Registered users have access to recent transactions reports. You don't need a subscription to register, it's free.

About VPPerform

VPPerform supports clients in winning deals and developing existing or new strategic accounts.

- © 2025 Copyright VPPerform

- Disclaimer

- Terms of Use

- Privacy Policy

- Contact

-